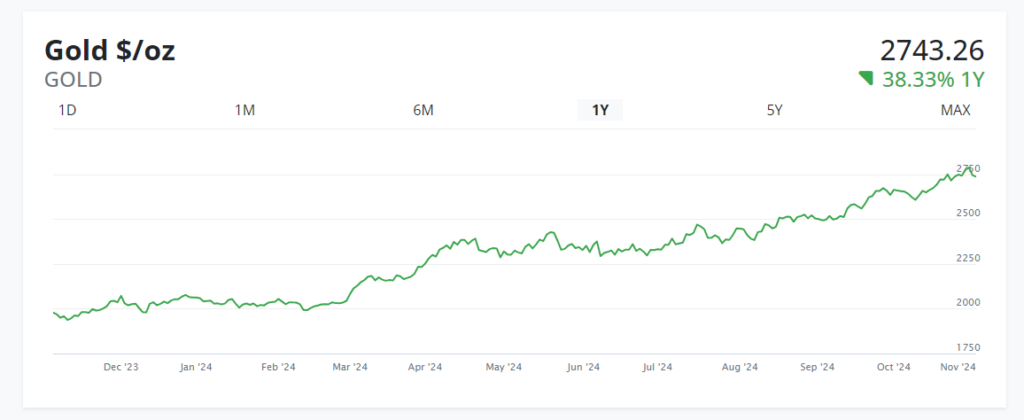

Gold’s blinding comeback

Gold has made a tremendous comeback in recent years amid increased geopolitical tension, greater demand from central banks, and new investment products offering easy ways to gain exposure to the precious commodity.

This is a far cry from the pre-pandemic trends when investors had little interest in gold as its performance lagged that of other asset classes.

Since 2019, the price of the precious metal has risen 85% as demand has spiked. According to the World Gold Council report, demand for gold hit a record high of $100 billion in the third quarter of 2024.

Krish Gopaul, a senior analyst at the World Gold Council, said overall demand for the commodity is up 5% year over year.

There is much discussion about what has driven this price rise, with many pointing to rising global uncertainty following the Russian invasion of Ukraine and fears of a regional war in the Middle East.

Typically, global uncertainty drives investors to flock to safe-haven assets, of which precious metals are a premier example.

While this is a factor, more fundamental shifts have occurred in the past five years that have driven demand for gold.

Chief among these is the steadily increasing demand for gold from central banks around the world as they also search for stability amid elevated political and economic uncertainty.

Gopaul explained to 702 that central bank demand is important for sustained rallies in the price of gold as they not only have sufficient cash to move the market but are also relatively price-insensitive buyers.

Central banks tend to buy gold for the stability it offers alongside increased diversification away from government debt. Gopaul said they are strategic about why they buy gold and do not necessarily expect a return on the investment.

Another long-term shift that has driven the comeback of gold is the creation of new investment products for investors to increase their exposure to gold.

Gopaul explained that the launch of gold exchange-traded funds (ETFs) that physically hold the commodity on behalf of investors has enabled retail investors and institutional investors to increase their exposure to gold without having to store the commodity.

These long-term trends have been boosted by the fear of missing out, with investors increasingly interested in the commodity due to its strong performance.

As with any asset, a rising price results in rising interest and increased investment in it, Gopaul said, for fear of missing out and trying to ride the momentum.

As a result, the World Gold Council expects the price to continue rising towards the end of 2024, with demand remaining elevated amid geopolitical uncertainty.

Other industry experts have pointed to other reasons for increased central bank buying of gold, with much of the demand coming from emerging-market banks.

UBS Global Wealth Management’s Ekaterina Lehmann and Michael Bolliger pointed out that this rally began without traditional support from declining real interest rates.

They said the rally could be due to fears of higher-for-longer inflation and attempts from investors to look for a safe haven alternative to dollar-denominated assets due to a rapidly growing US debt burden.

One factor Lehmann and Bolliger pointed out as being overlooked is fear of sanctions from the US being used on countries it has ideological differences.

They said the US has consistently weaponised the dollar’s role as the world’s reserve currency to hamstring ‘rogue’ states economically.

In the case of Russia, after its invasion of Ukraine, the US effectively cut it out of the global financial system.

This has led to fears of the same happening to other countries, particularly China, which has rapidly sold off US Treasury bonds in favour of gold.

As a result, central banks in Russia, China, and India have been buying up gold aggressively to minimise their reliance on the dollar as a reserve currency.

For example, the People’s Bank of China (PBoC) has acquired 225 tonnes of gold – the largest annual increase in its history.

This has also been interpreted as a play by the Chinese central bank to protect the value of its local currency as the economy slows and its assets become less attractive.

A more recent driver of gold prices has been the decline in global inflation and a subsequent easing of monetary policy by cutting interest rates.

With central banks adopting more accommodative monetary policies, the cost of holding non-yielding assets like gold decreases, making it more attractive to investors.

Comments